Thank you page- Jbk It Technologies

Upcoming New Batches Book Your Slot Our Hiring Clients Review’s From Students Jbk it technologies is the very best knowledge sharing institute that I learnt digital Marketing

Upcoming New Batches Book Your Slot Our Hiring Clients Review’s From Students Jbk it technologies is the very best knowledge sharing institute that I learnt digital Marketing

Data Analytics Courses Home All Courses Power Bi Course Learn Power BI at JBK IT Technologies. Understand data visualization, reporting, and analytics to convert data

Hire From Us At JBK IT Technologies, we specialize in training and developing skilled professionals across various IT domains. Our graduates are equipped with the

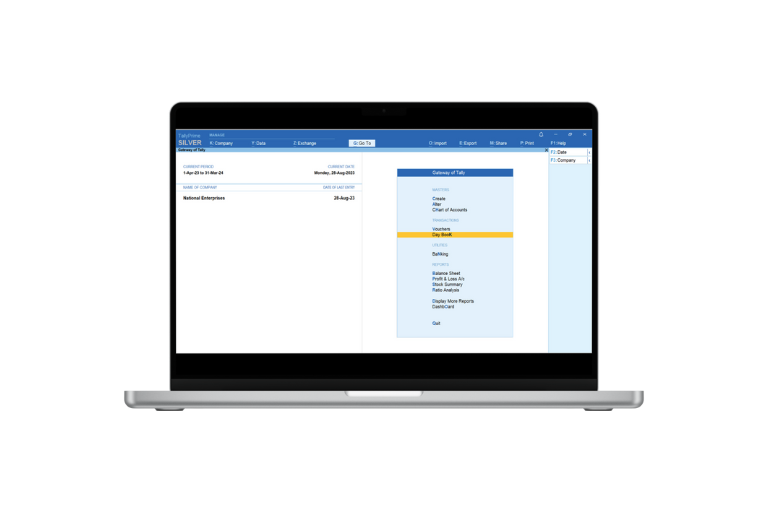

Finance Courses Home All Courses Tally With GST Course Learn Tally at JBK IT Technologies. Master accounting, financial management, and GST in Tally ERP. Understand

JBK IT Technologies is the Best Tally Institute in Ameerpet Hyderabad. Build your Career in Tally Prime, Advanced Tally Erp9 with GST from No.1 Software Training Institute in Ameerpet Hyderabad. It’s a Right time to learn Tally Course from Basic to Advanced level with Placements. Learn Tally Training from Experts in Ameerpet Hyderabad. We Offer job oriented and placement Focused Classroom, Online Tally Training in Ameerpet Hyderabad. The Tally with GST course offered covers the usage of Tally ERP software for managing accounting and financial processes with a focus on Goods and Services Tax (GST) compliance. Participants will learn how to use Tally ERP effectively for GST-related tasks such as generating GST invoices, managing GST returns, reconciling data, and handling other GST-related transactions. The course provides hands-on training, practical exercises, and comprehensive knowledge to ensure learners are well-equipped to navigate the complexities of GST using Tally ERP. Best Tally With Gst training institute in Dilsukhnagar Hyderabad.

Tally is used to maintain the financial record of the company that includes net deduction, net payment, bonuses, and taxes. Tally is a widely used accounting software that helps businesses manage their financial, accounting, and inventory operations efficiently. Designed for small and medium-sized businesses, Tally simplifies complex accounting tasks by automating processes like bookkeeping, inventory management, and tax calculations. It offers a user-friendly interface, enabling users to record transactions, generate financial reports (such as profit & loss statements, balance sheets, and cash flow reports), and manage inventories with ease. Additionally, Tally is GST-compliant, allowing businesses to generate and file GST returns effortlessly. It also supports payroll management, helping companies calculate employee salaries, deductions, and other related financial activities. With its comprehensive features and real-time reporting, Tally makes it easier for businesses to maintain accurate financial records and ensure compliance with tax regulations. A Tally with GST course is a specialized training program designed to teach individuals how to use Tally ERP 9 (or Tally Prime) for efficient accounting, financial management, and GST compliance. As Goods and Services Tax (GST) has become an integral part of India’s taxation system, businesses must ensure their accounting practices align with the new tax structure. This course covers essential topics such as setting up GST in Tally, creating GST-compliant invoices, generating and filing GST returns (like GSTR-1 and GSTR-3B), and reconciling GST input and output. Participants also learn to generate various GST reports, track tax liabilities, and maintain accurate financial records in accordance with GST regulations. The course is ideal for accountants, business owners, and professionals involved in accounting, as it helps them streamline their accounting processes and ensure full GST compliance, making it a valuable tool for modern financial management. Best Tally with Gst training institute in Dilsukhnagar Hydereabad.

JBK IT Technologies offers a certification course in Tally with GST. This course focuses on providing in-depth knowledge and skills in using Tally ERP software for managing accounting and financial operations, specifically with regard to Goods and Services Tax (GST) compliance. Participants will learn about various features of Tally related to GST, including invoice creation, tax calculations, return filing, and generating GST reports. By completing the course and obtaining the certification, individuals can showcase their proficiency in Tally with GST, enhancing their career prospects in finance and accounting roles, especially in organizations dealing with GST compliance. The certification from JBK IT Technologies signifies expertise in using Tally for GST-related processes.

A Tally course typically covers topics like TallyPrime, accounting principles, financial transactions, inventory management, GST compliance, payroll management, and financial reporting.

Generally, there are no strict prerequisites for enrolling in a Tally course. However, having a basic understanding of accounting principles can be helpful.

Key modules typically include accounting basics, ledger creation, voucher entries, inventory management, GST compliance, payroll processing, and financial reporting.

Yes, Tally is fully compliant with GST regulations in India. It offers features for GST invoicing, return filing, and reconciliation, making it easier for businesses to manage their GST obligations.

JBK IT Technologies is One Of Best Training institute in Hyderabad.

Copyright © 2025 JBK Academy. All rights reserved.