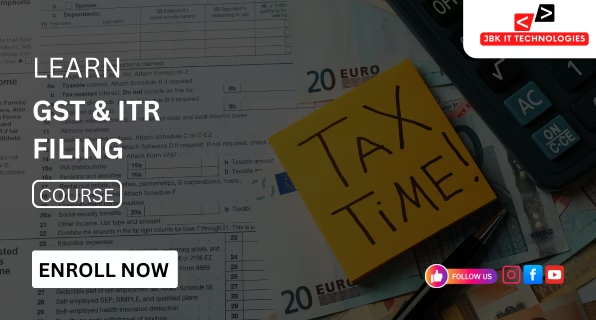

GST & ITR Filing Training Institutes In Dilsukhnagar Hyderabad

JBK IT Technologies is one of the best C Language Training Institutes in Dilsukhnagar Hyderabad, offering practical training.

Course Overview

GST, as well as ITR Filing, GST and ITR are now essential skills in today’s business and financial environment. If you’re a college student, an accountant, a tax advisor, or a business owner, understanding how to manage GST returns and tax filing for income is vital. At JBK IT Technologies, we offer practical GST and ITR filing classes that will allow you to manage tax-related issues effectively. This course will provide you with in-depth information about Goods and Services Tax (GST) regulations and filing procedures, in addition to the various tax returns (GSTR-1, GSTR-3B, GSTR-9) and the regulations for invoicing, ITC claims, and penalties. Additionally, you’ll learn the practical aspects of filing tax returns for income (ITR-1 until ITR-6) and also know how to register for PAN/TAN and access the government’s websites effectively. The course was designed to simplify tax law and be more efficient to ensure that students from all backgrounds can grasp the concepts in a short time. Through real-time scenarios as well as practical assignments and guidance on the techniques employed in the business and taxation world, this course will help for a successful career in finance or taxation. JBK IT Technologies offers flexible batch schedules, experienced instructors, and practical training at the 3 Dilsukhnagar Hyderabad branches: Ameerpet, Dilsukhnagar, and Mehdipatnam. The most effective GST and ITR Filing Training Institute in Dilsukhnagar, Hyderabad.

Description

The GST and ITR Filing course at JBK IT Technology is designed to assist students, accountants, business owners, and finance professionals in acquiring an in-depth, hands-on understanding of the tax system in India. With GST being among the biggest tax reforms that have occurred in India and tax filing being a year-long obligation for both businesses and individuals, this course is important and timely. This course will help you learn how to accurately file GST returns, handle tax compliance, and submit taxes online, both for private individuals as well as businesses. We cover a variety of subjects, including GST registration and invoice preparation, Input Tax Credit (ITC), electronic waybills, annual and monthly GST returns (like GSTR-1 and GSTR-3B), GSTR-9, and the most common mistakes to avoid when filing. On the one hand, on the Income Tax side, you’ll learn about filing ITR-1 and ITR-6 TDS returns and understanding Form 16 and the Income Tax online filing portal and the complete process of filing—starting with PAN verification through the upload of digital signatures. If you’re looking to join a CA firm, manage your company’s taxes, be an expert in tax planning, or manage tax-related personal expenses more effectively, the course provides you with the entire set of skills. By combining hands-on learning, cases, and instruction on the real-world government portals, such as GSTN or ITR, the Income Tax e-Filing website, you’ll be equipped for the challenges of real-time. JBK IT Technologies, located in Dilsukhnagar, Hyderabad (Ameerpet, Dilsukhnagar, Mehdipatnam), offers professional advice, flexible schedules, and complete assistance with placement to help you transform your learning into a lucrative career opportunity. The most efficient GST and ITR Filing training Institute located in Dilsukhnagar, Hyderabad.

Course Curriculum

MODULE 1: Introduction to Indian Taxation System

- Overview of Direct & Indirect Taxes in India

- Understanding PAN, TAN, GSTIN

- Basic tax structure and applicability

MODULE 2: GST Fundamentals

- What is GST? – Meaning, Importance, & Benefits

- Types of GST – CGST, SGST, IGST & UTGST

- GST Registration Process

- GST Invoicing & Billing Format

MODULE 3: GST Return Filing

- Overview of GSTR-1, GSTR-2A, GSTR-3B, GSTR-9

- Monthly, Quarterly & Annual GST Filing

- Input Tax Credit (ITC) Claim & Reversal

- Late Fees, Interest & Penalty Rules

Filing returns on the GST Portal (live demo)

- Overview of GSTR-1, GSTR-2A, GSTR-3B, GSTR-9

MODULE 4: E-Way Bill System

- E-Way Bill Generation & Tracking

- Inter-state & Intra-state Rules

MODULE 5: TDS Under GST

- When TDS is applicable under GST

- TDS Deduction & Return Filing Process

MODULE 6: Income Tax Filing – Individual & Business

- Types of ITR Forms (ITR-1 to ITR-6)

- Step-by-step Income Tax Return Filing Process

- Form 16 & Salary Income Computation

- Rental, Capital Gains & Business Income Filing

- Advance Tax & Self-Assessment Tax

MODULE 7: Filing via Income Tax Portal

- Creating & Logging into e-Filing Account

- Using DSC (Digital Signature Certificate)

- Uploading XML/JSON & Generating Acknowledgments

MODULE 8: TDS & Form 16 Filing (Non-GST)

- TDS Rates & Applicability

- Filing TDS Returns using TRACES Portal

- Generating Form 16 / 16A

Who can learn this course

The GST & ITR Filing course at JBK IT Technologies is designed for learners from both finance and non-finance backgrounds. You don’t need to be a tax expert to get started. Whether you’re looking to begin your career or enhance your professional skill set, this course can help you step confidently into the world of taxation and compliance.

1. Commerce and accounting students who want to build strong fundamentals in GST and Income Tax Return Filing.

2. Graduates looking for career opportunities in accounting, taxation, or CA firms.

3. Working professionals who want to upgrade their skills in GST return filing, ITR filing, and TDS.

4. Accountants and bookkeepers who want to handle GST compliance for clients or companies.

5. Small business owners and entrepreneurs who wish to manage their own GST filings and income tax returns.

Upcoming Batches

| Course Name | Start Date | Mode | Timing | Enroll |

|---|---|---|---|---|

| Ms Office | 02/02/2026 | Online/Offline | 06:00 PM | Book Slot |

| Advanced Excel | 02/02/2026 | Online/Offline | 11:00 AM | Book Slot |

| Tally with GST | 02/02/2026 | Online/Offline | 12:00 PM | Book Slot |

| Photoshop | 02/02/2026 | Online/Offline | 12:00 PM | Book Slot |

| Sap Fico | 02/02/2026 | Online/Offline | 03:00 PM | Book Slot |

| Java | 02/02/2026 | Online/Offline | 05:00 PM | Book Slot |

| Power Bi | 02/02/2026 | Online/Offline | 12:00 PM | Book Slot |

| C language | 02/02/2026 | Online/Offline | 02:00 PM | Book Slot |

Training Features

ISO Certified institute offering quality training and industry-recognized certification.

Industry experts with real-time project experience and teaching excellence.

100% placement support with interview preparation and resume building.

Hands-on training with practical, business-oriented Excel assignments.

Interview practice sessions to boost confidence and job readiness.

Interactive sessions for real-time query resolution and concept clarity.

Hiring Clients

Student Testimonials

Recently Placed Students

FAQ'S

Most Popular Questions

Not at all. Our GST & ITR Filing course is designed for both beginners and experienced learners. We start from the basics and gradually move into advanced filing topics, so even if you come from a non-finance background, you’ll be able to follow along.

Yes, our training is focused on hands-on experience. You will learn how to file real GST returns, ITR forms, generate e-way bills, and use both the GST and Income Tax portals through live practice sessions.

Absolutely. You’ll be trained on actual government platforms such as the GSTN portal, TRACES, and the Income Tax e-Filing site. We use real-time case studies so you can apply what you learn immediately.

Yes, we cover TDS deductions, return filing, and Form 16/16A generation in detail. You’ll also learn how to handle TDS for both salaried employees and contractors.

The GST & ITR Filing course typically runs for 4 to 6 weeks depending on the batch mode (regular or fast track). We offer both weekday and weekend batches with flexible timings.

Yes. Upon successful completion of the course, you will receive a course completion certificate from JBK IT Technologies which is recognized by many companies in Dilsukhnagar Hyderabad and across India.